How to Apply for Pag-IBIG Multi-Purpose Loan Using Email – A lot of people have been affected by the lockdown because of the COVID-19 pandemic. It’s been a very challenging time, and our government is trying to help us in any way they can. Here in this article, I’m going to teach you how to apply for Pag-IBIG MPL even when inside your home because of lockdown, by just using your email.

Requirements on Pag-IBIG Multi-Purpose Loan Application Using Email

- At least 24 Monthly Savings Contribution – It’s not necessary to have continuous monthly savings contributions. Just make sure that you have at least one contribution for the last six months. The important thing is you have a total of 24 monthly contribution

- Signature of your Employer in the Application Agreement Portion – With this requirement, it seems like this is only for active employees only. According to Pag-IBIG, this is required to ensure that you are using your benefits and to have your employers certify your capacity to pay for your Multi-Purpose Loan.

Steps on How to Apply for Pag-IBIG Multi-Purpose Loan Using Email

- Step 1 – Download the Pag-IBIG Multi-Purpose Loan Application Form by clicking the link below:

- Step 2 – Fill-up the form and send to your HR, Authorized representative, or Fund coordinator for signing purposes.

- Step 3 – Once approved, your HR, authorized representative, or fund coordinator needs to send it back to you. Make sure to check if it was correctly filled up and signed.

- Step 4 – Take a picture of any of your Landbank, DBP, UCPB Cashcard o Loyalty Card Plus. If what you have is Loyalty Card Plus, make sure to include front and back pictures.

- Step 5 – Take a picture of your valid ID. Check out the link below for the list: https://olanap.com/how-to/updated-list-nbi-clearance-valid-id/

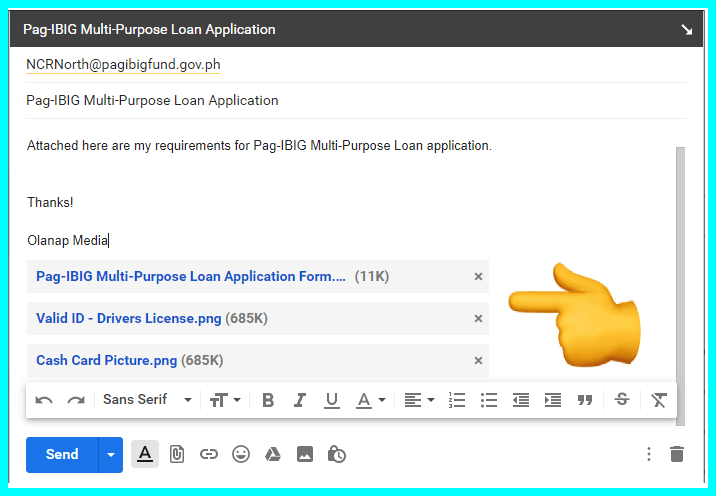

- Step 6 – Compose your email that includes the following:

- Filled up and signed Pag-IBIG Multi-Purpose Loan Application Form

- Cash Card: Landbank, DBP, UCPB Cashcard o Loyalty Card Plus

- Valid ID

- Send your email to the email address based on your location. Refer to the next section of this guide for reference.

Note: Pag-IBIG members who lost or doesn’t have existing Cash Card can still send their application. Just make sure to indicate what happened so that Pag-IBIG Fund can make adjustments on how to get your loan.

Where Do You Send Your Pag-IBIG Multi-Purpose Loan?

The email address where you need to send your Pag-IBIG Multi-Purpose Loan depends on the location of your SSS Regional District Office or RDO. Check out below for the full list:

- NCRNorth@pagibigfund.gov.ph – GMA Kamuning, Quezon Avenue, Commonwealth Avenue, Cubao, Marikina, Caloocan – EDSA, Valenzuela, Pasig, Mandaluyong – Shaw Zentrum and Antipolo branches

- NCRSouth@pagibigfund.gov.ph – Makati-Buendia I, Binan, Makati-Ayala Avenue, Makati-Buendia II, Makati-JP Rizal, Taguig – Gate 3 Plaza, Guadalupe-EDSA, Muntinlupa, SM Aura, Intramuros, Sta. Mesa, Binondo, Pasay, Las Pinas-Robinsons Place, Paranaque, Imus, Rosario, and Dasmarinas branches

- Ilocos@pagibigfund.gov.ph – La Union, Laoag, Vigan, Dagupan, Urdaneta, and Baguio branches

- Cagayanvalley@pagibigfund.gov.ph – Tuguegarao, Solano, and Cauayan branches

- Centralluzon@pagibigfund.gov.ph – San Fernando, Tarlac, Angeles, SBMA, Balanga, Malolos, Baliwag, Cabanatuan, and Meycauayan branches

- Southerntagalog@pagibigfund.gov.ph – Lucena, Batangas, Lipa, Calamba, San Pablo, Sta. Rosa, Calapan, and Palawan branches

- Bicol@pagibigfund.gov.ph – Legazpi and Naga branches

- Centraleastvisayas@pagibigfund.gov.ph – Cebu-Ayala, Dumaguete, Talisay, Toledo, Cebu-Colon, Mandaue, Danao, Mactan, Tagbilaran, Tacloban, Calbayog, and Ormoc branches

- Westvisayas@pagibigfund.gov.ph – Iloilo-Manduriao, Iloillo-Molo, Kalibo, San Jose de Buenavista, Roxas, Bacolod, Kabankalan, and Sagay branches

- Northmindanao@pagibigfund.gov.ph – CDO-Lapasan, CDO-Carmen, Valencia, Butuan, San Francisco, Surigao, and Iligan branches

- Westmindanao@pagibigfund.gov.ph – Zamboanga, Dipolog, and Pagadian branches

- Southwestmindanao@pagibigfund.gov.ph – Davao-Bajada, Davao-Matina, Davao-Lanang, Digos, Tagum, Panabo, General Santos, Polomolok, Koronadal, Kidapawan, and Cotabato branches

How Long Should I Wait For My Loan Approval?

Once the Pag-IBIG Fund received your Multi-Purpose Loan along with the complete requirements. You can receive your loan money within (7) Seven to (20) twenty days.

How do I Know If My MPL Was Approved?

You will receive a Text from Pag-IBIG Fund if your Multi-Purpose Loan was approved. Another text will be sent once the money was credited on your Cash card.

How Much Would Can I Borrow With Pag-IBIG Multi-Purpose Loan?

With Pag-IBIG Fund’s MPL program, qualified members can borrow up to 80% of their total Pag-IBIG Regular Savings, which consist of their monthly contributions, their employer’s contributions, and accumulated dividends earned. If you have an outstanding Calamity Loan, the amount of loan you will receive shall be the difference between the 80% of your total Pag-IBIG Regular Savings and the outstanding balance of your Calamity Loan.

This means that the more you save in your Pag-IBIG Regular Savings, the higher the loan amount you may apply for via the MPL.

How To Guides By Olanap Media

I’m so happy that Pag-IBIG Fund gives us a chance to Apply our Pag-IBIG Multi-Purpose Loan Using Email. It’s obvious that our country is not prepared for the Coronavirus outbreak, but at least our government is doing its best to give us aid. Hopefully, COVID-19 will be gone soon, and everything will go back to normal.

That would be it! I hope our guide about “How to Apply for Pag-IBIG Multi-Purpose Loan Using Email” helped you in your Financial Needs. Please leave a comment for any suggestions, corrections, and concerns about this post. You can also email me at hello@olanap.com. To get updated with our content just like our Facebook page: Olanap Media and follow our Twitter: @OlanapMedia

Tell Us What You Think