How to recover lost TIN in the Philippines in two easy steps

How to recover lost TIN in the Philippines – The Tax Identification Number is one of the most underrated requirements in the Philippines. But if you lost or forgotten it I’m sure that you will be doomed. Why? Because there are only two ways to get it back and it is not available online. So read the instructions below in order for your to recover your TIN.

What is a TIN?

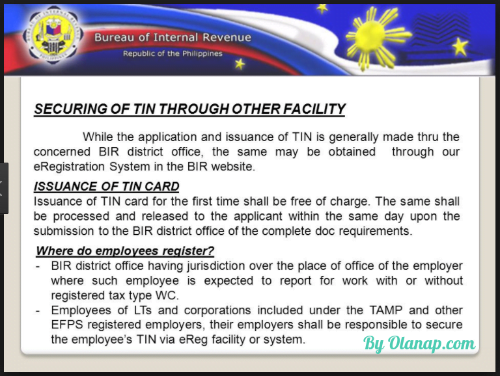

Any person, whether natural or juridical, required under the authority of the Internal Revenue Code to make, render or file a return, statement or other documents, shall be supplied with or assigned a Taxpayer Identification Number (TIN) to be indicated in the return, statement or document to be filed with the Bureau of Internal Revenue, for his proper identification for tax purposes.

How to recover lost TIN in the Philippines in two easy steps

How to recover lost TIN in the Philippines through Phone

Before the internet has become the go to option to look for searching something there is what we call Telephone. So what you will do is to simply call BIR Contact Center by dialing (02) 981-8888. A BIR representative will attend to you and ask for your name and answer a few verification questions in order for you to recover your lost TIN. This is done in order to ensure the confidentiality of the tax information because our Bureau of Internal Revenue don’t want to disclose you TIN to unauthorized person.

How to recover lost TIN in the Philippines bygoing through BIR Revenue District office

If calling fails which normally is because of complex verification method BIR are imposing. The next thing to do now is to visit the BIR Revenue District office. This second option however, is the more direct one because you will have to go to an RDO. You can search the internet to locate where the nearest RDO is from your location. Be prepared to present a valid ID and it can either be a government-issued ID or a company ID. To be extra sure, bring documents like your NSO-certified birth certificate, marriage contract, etc. for verification. They will not entertain you if you have none

As of now, the BIR has not yet discussed online retrieval of TINs but if they do, it would be a great and pleasant treat for everyone; no more hassle of calling and no more hassle of finding and going to the nearest RDO. But rest assured if that option will be available Olanap.com will be the first to publish it.

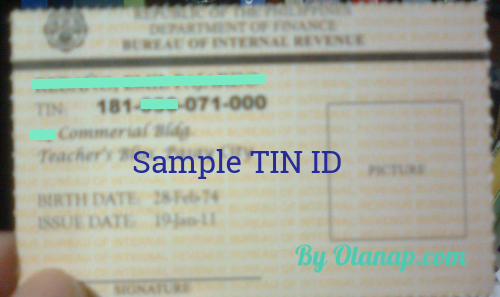

How to get a TIN ID so you won’t forget your TIN

How to get a TIN ID so you won’t forget your TIN

It is easy to get a TIN ID because there are a few requirements. Applicants should just bring their NSO Birth Certificate with them. Moreover, they need to bring at least one valid ID especially for those who have existing TIN already.

- Go to the local BIR office in the city or town.

- Bring birth certificate and valid ID.

- Fill up TIN application form (there are different kinds of forms, ask assistance to find the right form).

- Submit the application form at the counter. Present a valid ID or the birth certificate.

- Wait for Tax Identification Number to be given.

- Request for your TIN Card ID, which applicants are entitled to according to E.O. 98.

- Wait for the ID. If the office is not busy, it can be processed within 1 hour. However, during very busy days, applicants may need to return the next day.

Super Easy right? Like always Olanap.com delivers.

Also READ: BIR Form 2316 updated guide and download

Another helpful guides from Olanap.com to the Filipino people

I hope you enjoyed our Olanap.com “How to recover lost TIN in the Philippines” article as always here we are delivering the most updated Online Guide out there. Do not forget to leave a comment below for any clarifications. For updated post you can subscribe to our Mailing list, Bookmark our website or Like our Facebook Page. You can also email us at hello@olanap.com Cheers!

Tell Us What You Think