Pag Ibig Calamity Loan and the Philippines

Pag Ibig Calamity Loan – The country is no stranger to natural disasters, as it is surrounded by bodies of water, and is located along the Pacific Ocean’s “Ring of Fire.” From typhoons to tsunamis to volcanic eruptions to earthquakes – name it, the Philippines has experienced it. That is why it’s good to know that we have a Pag Ibig Calamity Loan waiting to be used once these incidents happened. Olanap.com wrote this article to give you the best and easiest way on how to apply for Pag Ibig Calamity Loan.

How to Apply for Pag Ibig Calamity Loan?

- Step 1 – Check for your eligibility on the Pag Ibig Calamity below:

- You must completed 24 monthly savings.

- Is an active member with at least 5 monthly saving for the last 6 months prior to the date of loan application; and the most important would be

- Resides in an area which is declared by the Office of the President or the Local Sangunian as under a State of Calamity

- Step 2 – Download the Pag Ibig Calamity Loan Application form below and fill it up correctly

Calamity Loan Application Form –

––

–

– - Step 3 – Proceed to any Pag Ibig Office nationwide. I listed some of them below:

- SM Aura-Taguig Member Services Branch

7/F SM Aura, Taguig City

Email Address: taguig.frontline@pagibigfund.gov.ph; taguig.me@pagibigfund.gov.ph

Trunkline: (02) 422-3000 - Quezon Avenue Member Services Branch

# 12 Quezon Avenue cor 7 Kitanlad Street, Quezon City

Trunkline # (02) 422-3000 / Telephone # 925-6754 - Biñan Member Services Branch

2nd Floor, Umbria Commercial Center, National Highway, Tulay Bato,

San Antonio, Binan Laguna (beside Pavilion Mall)

Email Address: binan.me@pagibigfund.gov.ph

Trunkline: (02) 422-3000; (049)511-8284

- SM Aura-Taguig Member Services Branch

How to apply for Pag Ibig Calamity Loan

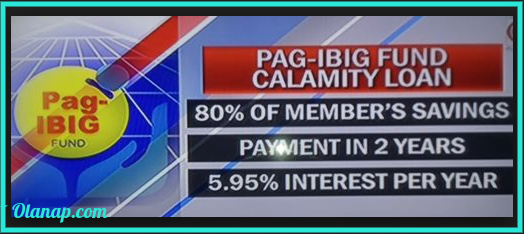

How much can you loan on Pag Ibig Calamity Loan?

- An eligible member may borrow up to a maximum of 80% of his Total Accumulated Value (TAV) subject to the terms and conditions of the program.

- The current interest rate for the Calamity Loan is 5.95% per annum.

What is the payment period for Pag Ibig Calamity Loan?

- The Calamity Loan is amortized over a period of 24 months with a grace period of 3 months. Said member shall start paying his loan on the 4th month following the date of his DV/Check date.

Can a member still avail of a Calamity Loan even if he has an outstanding MPL/Calamity Loan?

- Yes, said member may still avail of a Calamity Loan subject to certain conditions. In no case, however, will the aggregate short-term loan (MPL and Calamity Loan) exceed 80% of the borrower’s TAV.

Until when can an eligible member avail of the loan?

- Eligible borrowers must avail of the Calamity Loan within a period of 90 days from the declaration of a

state of calamity.

For inquiries about Pag Ibig Calamity Loan?

- Pag-IBIG Fund’s hotline is open 24/7 – (02) 724-4244. E-mails can be sent to publicaffairs@pagibigfund.gov.ph.

Also read: How to apply for SSS Calamity Loan and how much will it be?

Good luck with your application my dear subscribers!

I hope you enjoyed our Olanap.com “How to apply for Pag Ibig Calamity Loan Updated Guide 2017” article as always here we are delivering the most updated Online Guide out there. Do not forget to leave a comment below for any clarifications. For updated post you can subscribe to our Mailing list, Bookmark our website or Like our Facebook Page. You can also email us at hello@olanap.com Cheers!

Tell Us What You Think