BIR Form 2316 is one of the most important forms that an employee should be familiar about. It is the proof that your employer is doing it’s job on paying your taxes. During the course of the year every pay day I know how it feels to look at your payslip and read on that part called Tax withheld. So let me give you everything you need to know about BIR Form 2316.

BIR Form 2316 Download

First here is a PDF file of BIR Form 2316 that you can download

Form 2316 PDF DownloadWhat is the Use of BIR Form 2316?

Since January 2019 according to Bureau of Internal Revenue which collects and implement the filing of BIR Form 2316 the usage of the form is to:

Certificate to be accomplished and issued to each employee receiving salaries, wages and other forms or remuneration by each employer indicating therein the total amount paid and the taxes withheld therefrom during the calendar year.

– Bureau Of Internal Revenue BIR Form 2316 Definition

This Certificate in turn should be attached to the Annual Income Tax Return (BIR Form 1700 – for individuals receiving purely compensation income, or BIR Form 1701 for individuals with mixed income).

Who are Eligible to File Certificate of Compensation Payment / Tax Withheld

- Persons who are employed by two or more employers, any time during the taxable year.

- Persons who are self-employed, either through conduct of trade or professional practice.

- Persons who are deriving mixed income. This means you have been an employee and a self-employed individual during the taxable year.

- Persons who derive other non-business, non-professional related income in addition to compensation income not otherwise subject to a final tax.

- Persons who are married, employed by a single employer, and your income has been correctly withheld—the tax due is equal to the tax withheld—but your spouse is not entitled to substituted filing.

- You are a marginal income earner.

- Your income tax during the past calendar year was not withheld correctly—if the tax due is not equal to the tax withheld.

Also Read: BIR Form 2305 Download

Things to Remember Before Filing BIR Form 2316

BIR Form 2316 is a certificate that must be accomplished and issued yearly by the Payor (Individual) or Employer (Business) to each employee whose income is subjected to final tax declaration. The employer must indicate the total amount that was paid to the employee and the corresponding taxes withheld during the calendar year.

The most common misconception by most employees is that the BIR Form 2316 is only for those who has a salary that is above minimum. That is why at the end of the year those people don’t even bother getting that form on their employer.

But the truth is even if you are below the minimum salary your employer must give you BIR form 2316. This will also ensure that the business you are employed right now is legit and paying its due to our country.

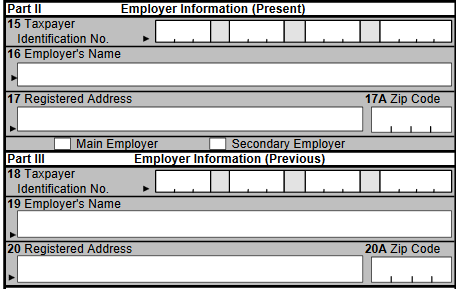

BIR Form 2316 New and Old Employer

If in the middle of the year you changed from one employer to another and notice a sudden increase in the tax deducted on your salary. BIR Form 2316 will explain everything.

Its the reason why it’s being required by your new employers themselves. That is because there’s a new rule in Bureau of Internal Revenue where your old withholding tax will still be a factor along with your new calculated tax in your new employer.

Filing Date of BIR Form 2316 and Release of Income Tax Return

BIR form 2316 is to be issued to payee on or before January 31 of the succeeding year in which the compensation was paid, or in cases where there is termination of employment, it is issued on the same day the last payment of wages is made.

So for example your salary cut off is 6th and 21st of the month the last payment of wages for the year 2018 is January 21st 2019 so what I suggest to you is to get your payslip and compare them both to see if there’s a significant change in the tax that was being deducted to your salary by your employer.

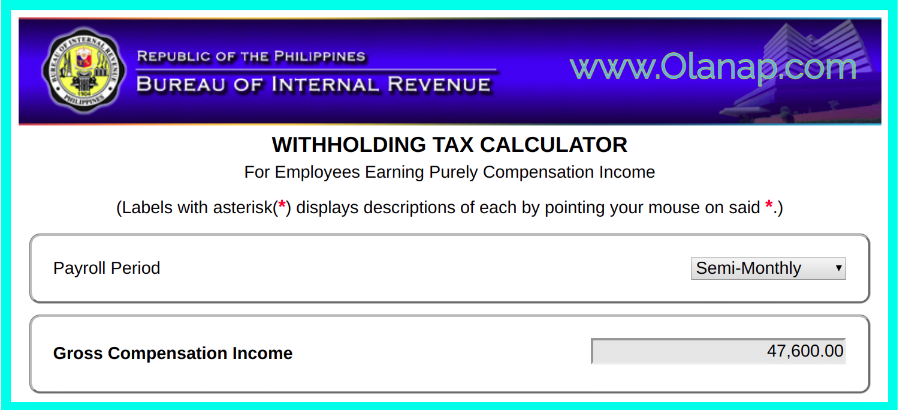

BIR Withholding Tax Calculator

If you have doubts whether you are being taxed abnormally or you didn’t get the correct Income Tax Return I would suggest for you to check out the BIR Withholding Tax Calculator below.

http://www.bir.gov.ph/images/tax_calculator/wt_calculator.html

January is the best time to compute this since pretty much you will be able to put anything there like the 13th month pay and other Other Benefits at the end of the year.

rose

May 5, 2017 4:13 amGood day!

I had 2 years working in a private school. My first year of work was paid for 7000 per month and then 7500 on the second year. We don’t have incentives nor bonuses for that. I filed a request for 2316 since I have a new employer this 19th of April 2017. Then now, I find out that my previous employer is not processing it yet. Is there any other way to have the 2316 immediately since I have a deadline of submission for this requirement?

arjiem

March 8, 2017 10:42 pmhello Jano, thank you for responding back, If I’m not mistaken, and I’ve experienced the same thing. Your new employer will not Require you to submit the current 2316 since it’s still within the annul taxation period but they may ask for a proof of your TIN and would ask you to sign an agreement that your previous employer has not given the most updated 2316 yet. Your tax will be adjusted depending if your previous employer was able to deposit the tax amount collected during your employment with them. In most cases the previous employer should still deposit the taxes collected during your employment period with them to BIR.

Jano

March 8, 2017 3:40 pmWhat if the employer return back to you your taxes from January-July after you resign from them? and then here comes the request of your new employer to provide a copy of your 2316 and now you cant provide it since your employer did not file your 2316 cause they already get back to you your taxes. My previous employer can issue me a copy of my 2316 but it is not received and paid to the bir. What will be the remedy with this kind of case?