How To Open An Account in BDO 2019 Requirements – After the success of our previous article on opening a BPI Checking Account we now present you this very informative guide on opening different types of account in BDO. The types of BDO Accounts we will cover includes:

All the information here in this article are accurate as of February 15, 2019.

How To Open A Peso Savings Account in BDO

What’s good about the BDO Peso Savings Accounts is that it offer endless possibilities to keep and grow your money. Whether you’re saving for a long-term goal or setting aside money for upcoming commitments, there’s an option for you. For as little as ₱ 2,000.00 your balance can start earning interest.

- Step 1 – Prepare the Minimum Initial Deposit

- Passbook Savings – ₱ 5,000.00

- ATM Savings – ₱ 2,000.00

- Optimum Savings (Personal) – ₱ 30,000.00

- Optimum Savings (Business) – ₱ 50,000.00

- Junior Savers – ₱ 100.00

- Step 2 – Bring 2 Valid ID’s

- Click here for List of Accepted Valid ID in BDO

- Step 3 – Go To the Nearest BDO Branch

- Click here to Use the BDO Branch Locator

- Step 4 – For Faster Processing of Application on How to Open an Account in BDO Download and fill out the Customer Information Record Form [HERE] before going to the BDO Branch

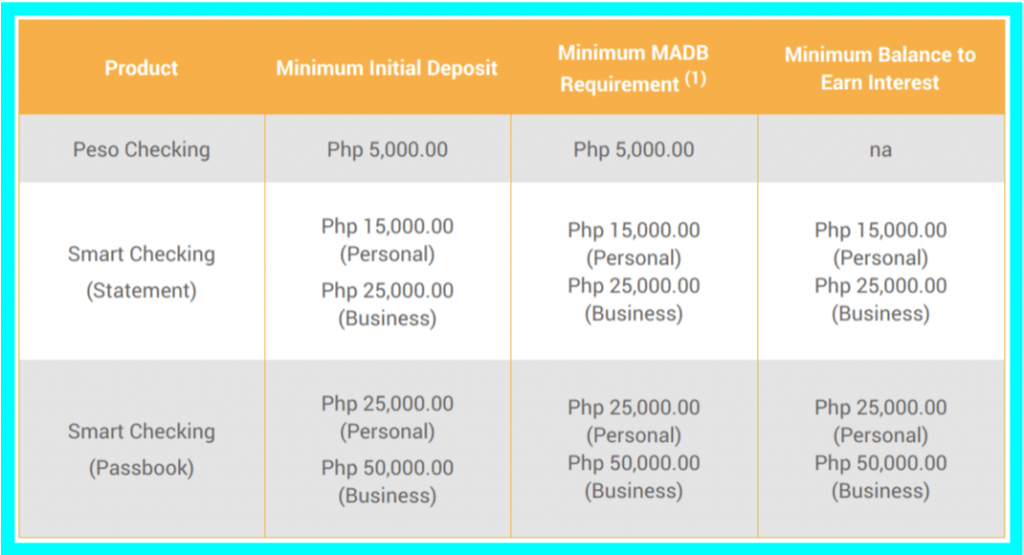

How To Open A Checking Account In BDO

IF you’re main goal to create a bank account is to issue checks, then the BDO Checking Account is what you need. BDO Checking Account gives you the convenience of disbursing funds through issuance of checks while easily monitoring your transactions through Online Banking or a Passbook.

- Step 1 – Prepare the Minimum Initial Deposit

- Peso Checking – ₱ 5,000.00

- Smart Checking (Statement)

- Personal – ₱ 15,000.00

- Business – ₱ 25,000.00

- Smart Checking (Passbook)

- Personal – ₱ 25,000.00

- Business – ₱ 50,000.00

- Step 2 – Bring 2 Valid ID’s Click here for List of Accepted Valid ID in BDO

- Step 3 – Go To the Nearest BDO Branch Click here to Use the BDO Branch Locator

- Step 4 – For Faster Processing of Application on How to Open an Account in BDO Download and fill out the Customer Information Record Form [HERE] before going to the BDO Branch

How To Open US Dollar Account in BDO

Are you an OFW who earns in US Dollar? Then the US Dollar BDO account is just for you. As your account grows with BDO, you’ll enjoy secure and easy access to your money wherever you are in the world using BDO Online Banking. BDO also have amazing features like fixed interest rates, cashless travel, low remittance rates, and a range of options for banking overseas.

- Step 1 – Prepare the Minimum Initial Deposit of $ 200.00

- Step 2 – Bring 2 Valid ID’s Click here for List of Accepted Valid ID in BDO

- Step 3 – Go To the Nearest BDO Branch Click here to Use the BDO Branch Locator

- Step 4 – For Faster Processing of Application on How to Open an Account in BDO Download and fill out the Customer Information Record Form [HERE] before going to the BDO Branch

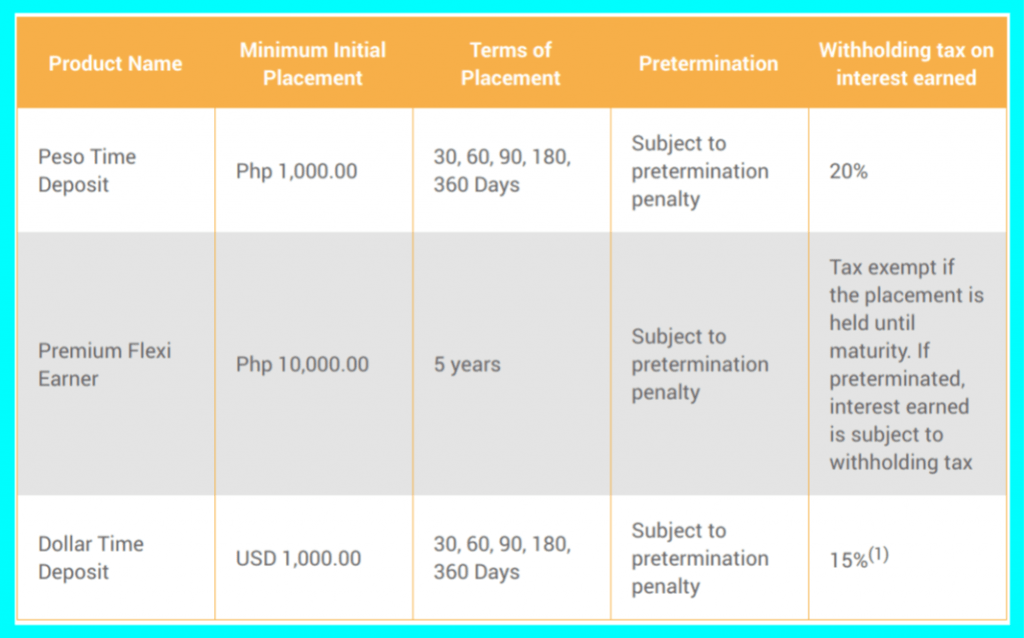

How To Open Time Deposit Account in BDO

Now this is for all the rich kids out there who’s looking to invest. Putting your funds in a time deposit account is a good way to start. BDO Offers not just Peso but Dollar Time Deposit as well.

- Step 1 – Prepare the Minimum Initial Deposit

- Peso Time Deposit – ₱ 1,000.00

- Premium Flexi Earner – ₱ 10,000.00

- Dollar Time Deposit – $ 1,000.00

- Step 2 – Bring 2 Valid ID’s Click here for List of Accepted Valid ID in BDO

- Step 3 – Go To the Nearest BDO Branch Click here to Use the BDO Branch Locator

- Step 4 – For Faster Processing of Application on How to Open an Account in BDO Download and fill out the Customer Information Record Form [HERE] before going to the BDO Branch

BDO Customer Information Record Form Download

BDO-CIR-Personal-09-06-2017How To Get Approved when Opening an Account in BDO

Before, in Philippine Banking it is true that Money Speaks. But with the on going implementation of the Anti Money Laundering Law the Banco De Oro may require additional documents from the above requirements before giving you an account. These documents of course will prove that the money they will be saving in their bank is clean.

Unemployed applicants need not to worry as well as long as you can maintain the Minimum Account Deposit Balance or MADB. Specially if you will just be opening a Savings account. Again once you started filling your Bank account with more money BDO may then require additional requirements.

What you need to be wary though is that you don’t have any existing loan on other banking institution as they have a centralized system to figure this out. Specially if you will request a credit card associated to your BDO account.

I would like to highlight to you readers that it is still better if you go to the nearest BDO branch and talk to them directly in your banking needs. This guide was created to give you the basics of Opening an Account with BDO. But when it comes to approval, It is depends on the situation you are in.

That would be it! I hope our guide about “How to Open An Account in BDO” have helped you in your Banking Needs. Please leave a comment for any suggestions, correction and concerns about this post. You can also email me at hello@olanap.com. To get updated with our content just like our Facebook page: Olanap Media and follow our Twitter: @OlanapMedia

Tell Us What You Think